How To YOLO Your Life Savings (and make millions) - 雙語字幕

So I like to tie it like this.

There are a lot of ways you can do it.

I just look it up on Google if you need help.

Now you can do this after.

I've always liked to do it beforehand just because I like to be prepared.

A good rule of thumb is that if your ratio between the days until exploration and percentage out of the money is less than one,

you're probably going to want to tie this as soon as possible.

You're also going to need a good reserve of Wild Turkey and Adderall, commonly referred to as Yolo Fuel.

This combo helps level out your mental state as you push your position to the move.

Without it, the only thing you're going to be pushing is the sell button.

Now go to your bank and get the biggest loan you possibly can.

Borrow against home equity,

max credit card,

and find private lenders so that you can reach maximum leverage, preferably 25 to 1 if you want a YOLO like the greats.

Interest rates don't matter because either you'll be a multi-millionaire by the end of a week or dead.

A house, car, daughter, all things that are great to use is collateral to buy your one-way ticket to the moon.

Just it all away and worry later.

This step is kind of optional, so just going to skip it entirely.

Select a random number between your entire 401k and your entire 401k.

I'll go with my entire 401k this time.

The next step is to buy complicated, depreciating financial derivatives that have multiple volatile moving parts affecting the price, none of which you understand.

You can do this by going to randomstockpicker.com and pressing the refresh button until you see a symbol that you think looks cool.

Grab a copy of the Intelligent Investor and open to a random page.

Read until you see either a C or a P.

If C comes first, buy calls.

If P comes first, buy puts.

However, before you buy them, inverse yourself and buy the exact opposite.

Unless you get puts,

then just buy calls because stocks only get Now go on to Wall Street Bets and write a self-affirming due diligence post in your half-drunken state.

The number of rockets you include at the end of your duty is the percentage likelihood this trade will work,

so make sure to add a lot.

Quick Robin Hood, find your stock ticker.

Find the option furthest out of the money with the nearest exploration and drop your entire four alarm came and blast off.

Down deep into the Earth, as your money slowly becomes a generous donation to a hedge fund manager's wine collection.

Why is it that buying options took away all of my options?

This is most likely a question you've asked yourself if you yellow with the method I just described.

There actually is a right and a wrong way to lose money.

When you're trading options, you want to make sure you're actually giving yourself a chance at making money.

So forget everything I just said, except for the I like to visualize options like this.

This line represents the probability that you'll make money on a trade.

When you first start, you're right here.

Even though each trade may seem like a coin flip, your likelihood of making money.

Let's zoom in on Diagram B to take a closer look.

This of the chart represents something called the retard differential.

The between A and B is the reason you see all-time Robin Hood graphs that have never been green.

It's also most likely the reason your life savings evaporated into nothing faster than you anticipated.

What causes this differential?

The answer is simple.

Options, mechanically, are complicated.

Fortunately, you don't need to understand the mechanics incredibly well to make money trading them.

However, if you do understand a few key ideas, you can consistently make more money, or lose less money so fast.

A lot of this is information I've gathered from Wall Street Betsby.

numbers that are significantly less retarded than myself.

I'm going to include all the original posts in the description and I'd highly recommend reading over them.

I'm also not going to explain what options are in this video.

This is more of an I understand what options are but don't know how to make money with them yet video.

So if you're one of the 8 million members of Wall Street Bets this might help you.

A large part of an options price is the volatility of the underlying stock.

Which would you pay more for?

A 5%

out-of-the-money call or the underlying stock has regular daily fluctuations of 5%,

or a 5% out-of-the-money call where the underlying stock has regular daily fluctuations of 1%.

Assuming both options have 5 days until expiration, you probably pay more for the first call option.

That's because it's more likely to be in the money at some point before your expiration date.

This is very important to understand if you want to have any success trading option.

A some point the Ideally, you want to buy an option when its implied volatility is very low, and sell when it's much higher.

There are a lot of strategies that go along with this that I'll discuss in the future.

However, for now, before you drop your life savings into an option play, take a look at

the historic implied volatility of the stock,

then look at the implied volatility right now and see if you're buying an option at a relatively high level.

Keep in mind that you're trying to buy- low IV relative to their historic average IV.

Just because Tesla looks like a heart rate monitor doesn't mean there isn't an opportunity there.

As long as IV goes up relative to what it is now, you're in the green.

When you buy shares of stock, the thing you have to predict is what direction the stock will go.

And that's usually pretty easy because stocks only go up.

However, with options, you not only have to predict the direction the stock will move, but also how much it will move and how quickly.

This is a massive reason why people lose money trading options.

You can be right with your prediction, but are you right enough?

And are you right more than what was anticipated by the market?

When other people will be volatile.

Option prices go up, and degenerates on Wall Street bets by them because they think the stock is about to make a big move.

The problem is that everyone thinks the stock is about to make a big move,

meaning that the options are priced efficiently for a big move.

When it inevitably doesn't make as big a move as anticipated, IV drops and degenerates lose their student.

This is IV Crush.

Understanding the various ways implied volatility will either fuck your position or make you money is one of the most important things to learn about options early on.

IV can legitimately destroy your entire trade if you aren't careful.

It can also make you a lot of money if you play it right.

If you're planning to put any significant amount of money on an option plan, I'd recommend buying at least a month until expiration.

These YOLOs with just days until expiration are insanely retarded and you're very likely to lose money on them.

Because options have expiration dates, they decrease in value every day that they're out of the money.

This value is called Theta, and it's one of the long list stock things that'll steal your fortune faster than Mackenzie Scott.

A call option with a current price of $2.00 and a Theta of negative 0.05 will experience

a drop in price of $0.05 per day.

So in two days time, the price of the option will fall to $1.90.

However, what happens when you buy an option with three days until expiration?

itself may only be worth $0.15 in total.

That means that the same fate of 0.05 is burning 30% of your initial investment per day.

This is how theta can ruin your life.

Another issue with buying options that are close to expiration is that you're at the

complete mercy of the randomness and impulsiveness of the stock market.

Jeff Bezos could tweet tomorrow.

that he's going to be moving his primary residence to little St.

James.

All of a sudden, your calls are out of the money.

Not say that options with a month until expiration make you completely invulnerable to this.

You're never invulnerable to this.

However, if you've bought longer term options, your will at least be manageable when Tim Cook claims that he's going to be yoloing

most of his Apple share and to pass.

Volunteer FDs and it will happen like Johnny Cash said you can run on for a long time sooner or

later Elon Musk will tweet that the stock is too high while you're holding calls

Not understanding the risks of implied volatility and the risks of short-term options are two of the biggest things that have caused me to

Lose money in the past like we can see in the retard difference When you start trading options,

it's really easy to think that puts and calls are a coin flip.

Just in mind that there are other factors at play, for better and for worse.

If can understand some of these simple ideas,

they can help you make money, and move you up the ladder towards your rightful position as a chat investor.

Help put you in a position where you can start losing money professionally.

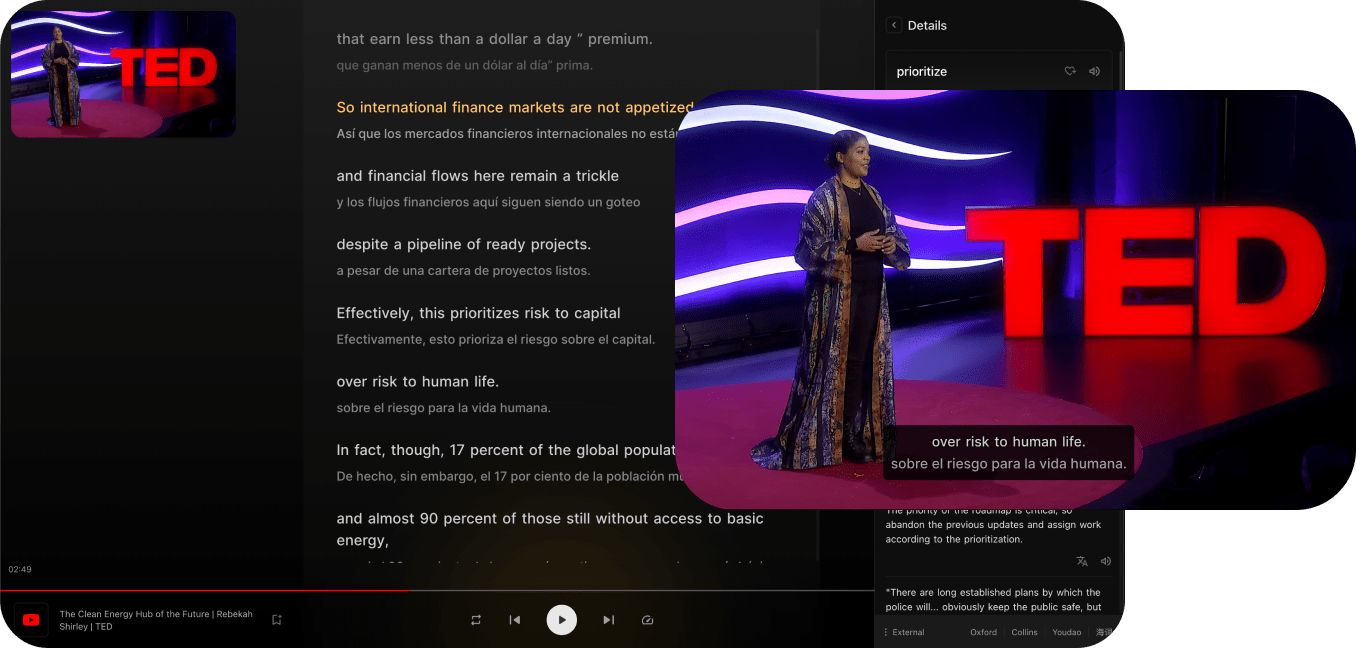

解鎖更多功能

安裝 Trancy 擴展,可以解鎖更多功能,包括AI字幕、AI單詞釋義、AI語法分析、AI口語等

兼容主流視頻平台

Trancy 不僅提供對 YouTube、Netflix、Udemy、Disney+、TED、edX、Kehan、Coursera 等平台的雙語字幕支持,還能實現對普通網頁的 AI 劃詞/劃句翻譯、全文沉浸翻譯等功能,真正的語言學習全能助手。

支持全平臺瀏覽器

Trancy 支持全平臺使用,包括iOS Safari瀏覽器擴展

多種觀影模式

支持劇場、閱讀、混合等多種觀影模式,全方位雙語體驗

多種練習模式

支持句子精聽、口語測評、選擇填空、默寫等多種練習方式

AI 視頻總結

使用 OpenAI 對視頻總結,快速視頻概要,掌握關鍵內容

AI 字幕

只需3-5分鐘,即可生成 YouTube AI 字幕,精準且快速

AI 單詞釋義

輕點字幕中的單詞,即可查詢釋義,並有AI釋義賦能

AI 語法分析

對句子進行語法分析,快速理解句子含義,掌握難點語法

更多網頁功能

Trancy 支持視頻雙語字幕同時,還可提供網頁的單詞翻譯和全文翻譯功能